The Race to Zero: Fighting Climate Change with Decarbonisation Solutions

With a net zero economy by 2050 as the global goal, Temasek and other companies are accelerating decarbonisation efforts to significantly reduce or remove carbon emissions.

- Urgent climate action is needed to achieve net zero emissions by 2050; this will shape the business landscape for decades to come, presenting investment opportunities worth trillions of dollars.

- Temasek has invested in companies like Eavor and Svante, which aim to change the way the world produces energy and raw materials using innovative decarbonisation technologies.

- Tackling climate change will require the world to use every tool available. High-quality carbon credits, such as those made available through upcoming carbon credits marketplace Climate Impact X, can help corporates address unavoidable carbon emissions in the near term and complement broader decarbonisation efforts.

The carbon clock is ticking.

Recent estimates suggest that the world has just 8 per cent of its carbon budget left. That's the maximum amount of carbon emissions that can be released into the atmosphere before temperatures rise 1.5 degree Celsius above pre-industrial levels. An increase over that would lead to even more severe climate-related risks to health, livelihoods, food security and more, cautioned the Intergovernmental Panel on Climate Change (IPCC) .

A self-proclaimed “possibilist”, Steve Howard, Temasek's Chief Sustainability Officer, remains undaunted. “There are many possible futures,” he says. “We could have runaway climate change, or we could be the generation that ends global warming.” The latter remains within reach, thanks to growing awareness of the need for urgent climate action and disruptive innovations in critical sectors like energy and agriculture.

To stop the warming of our planet, the IPCC reported that the world must reach “net zero” — where the amount of carbon emissions released is equivalent to the amount removed — by 2050. Temasek is committed to achieving net zero carbon emissions by 2050, and halve the net carbon emissions attributable to its portfolio by 2030.

Climate awareness will affect every decision, from policies to investments, and the way we choose to build our future, notes Howard. It will shape the global business landscape for decades to come, presenting investment opportunities in sustainable solutions worth trillions of dollars.

“The green industrial revolution is a once-in-a-lifetime business opportunity,” Howard says.

There are many possible futures. We could have runaway climate change, or we could be the generation that ends global warming.

Steve Howard

Chief Sustainability Officer

Temasek

Investing in Tech to Power a Cleaner World

To meet net zero, the world will need to fundamentally change the way we produce what we need. The use of energy — be it for industry to produce materials like iron and steel, or to power our homes — accounts for nearly three-quarters of global greenhouse gas emissions, according to the World Resources Institute's data platform Climate Watch.

To accelerate the change that's needed, Temasek has been investing in climate aligned opportunities — such as in companies that are avoiding carbon emissions at the source.

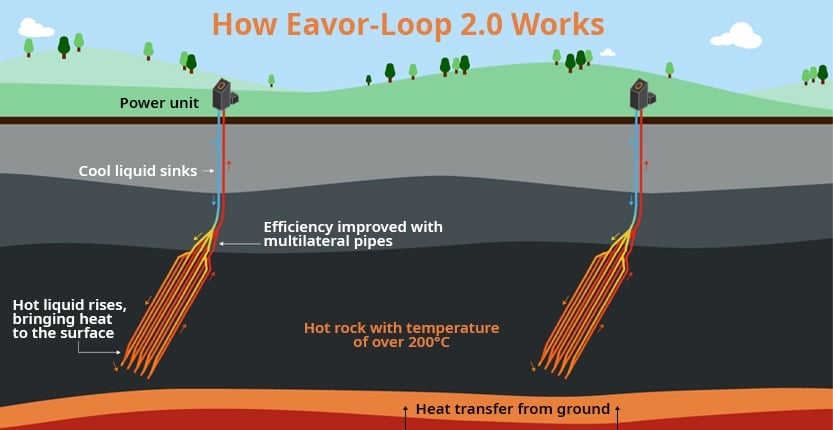

One of these companies is Canada-based geothermal firm Eavor, which has developed Eavor-Loop, a proprietary closed-loop system that harvests the Earth's heat to generate clean and scalable energy on demand.

It's estimated that the temperature rises by around 25 degrees Celsius with every kilometre towards the Earth's core. Thanks to our planet's inherent heat, the liquid poured into the pipes is naturally circulated, with hot liquid rising and cool liquid falling. The hot liquid brings thermal energy to the surface, which can then be converted into energy.

Unlike typical geothermal energy power plants, which are site-specific and could increase the risk of earthquakes, Eavor says its solutions are benign and can be implemented almost anywhere on Earth. That includes near urban centres, or even in remote areas that lack access to electricity. Typical power installations, which have about 10 Eavor-Loops on the same location, can deliver enough electricity for up to 100,000 homes, Eavor adds.

Another Canada-based company that is using technology to cut emissions is carbon-capture pure play firm Svante. Svante focuses on cost-effective solutions to trap the carbon emissions produced by industries such as cement, limestone and large scale hydrogen production, which are among some of the biggest contributors to greenhouse gas emissions.

Its solution in a nutshell: to use specially engineered nano-adsorbents to trap carbon dioxide and release it in 60 seconds when it is produced at industrial plants via a flue gas. Flue gas, a by-product of combustion processes, is a gas mixture that consists of carbon dioxide and other gases, including primarily nitrogen.

Capturing and separating carbon dioxide can be complex and capital cost intensive. Unfold a sugar-cubed sized quantity of its nano-adsorbents and its molecular surface area will be equivalent to that of a football field, says Svante.

This means that fewer quantities of adsorbents and smaller equipment will be needed, translating to lower capital costs for businesses. “Lowering the capital cost of carbon capture systems for industrial emitters is critical to the world’s net zero carbon goals,” says Claude Letourneau, President and CEO of Svante.

According to the International Energy Agency (IEA), however, the decarbonisation technologies we have today are simply not enough to achieve net zero emissions. The world will need more solutions toward deep decarbonisation, many of which are not commercially ready. The IEA estimates that 35 per cent of cumulative carbon emissions reductions needed to reach net zero currently rely on technologies that are only at prototype or demonstration stage.

It will take time and money to bring these emerging technologies to market, it notes. “The companies that have these technologies have to scale them, and they have to scale them fast. We don't have the luxury of time,” says Howard.

To that end, Temasek has partnered with US-based investment company BlackRock to launch Decarbonization Partners, a series of investment funds that combines the two firms' collective investment insights and expertise to help accelerate decarbonisation solutions.

These funds will deploy private capital with a focus on early stage growth companies targeting proven, next-generation decarbonisation technologies including emerging fuel sources, grid solutions, battery storage, and electric and autonomous vehicle technologies, as well as in manufacturing and the built environment sectors.

“The more you roll these technologies out, the cheaper they will get,” says Howard. He cites the example of electricity from solar energy, which has seen prices plummet 82 per cent over the past decade.

Bridging the Gap with Carbon Credits

All in all, tackling climate change will require the world to use every tool available. This rings true especially for companies in traditionally carbon-intensive sectors, which may face challenges in working towards net zero. “The only way to deal with this is to look at how can they transform their businesses,” says Howard.

As corporates big and small scale new technologies and transition to a low-carbon operating model, carbon credits could prove to be a helpful tool. Carbon credits — which are produced by initiatives that reduce, avoid or remove carbon emissions from the atmosphere — have the potential to help such businesses move to a more sustainable path in the near term.

However, Howard cautions that businesses must not rely solely on carbon credits; they must have a detailed sustainability roadmap, as carbon credits are meant to complement absolute emission reduction efforts.

According to non-profit research organisation NewClimate Institute, the number of companies with net zero commitments have doubled since late-2019. Many of these commitments include carbon offset pledges, as businesses transition to new, lower-emission operating models. In turn, the demand for voluntary carbon credits could grow over 15-fold by 2030. By then, the market for carbon credits could be worth more than US$50 billion.

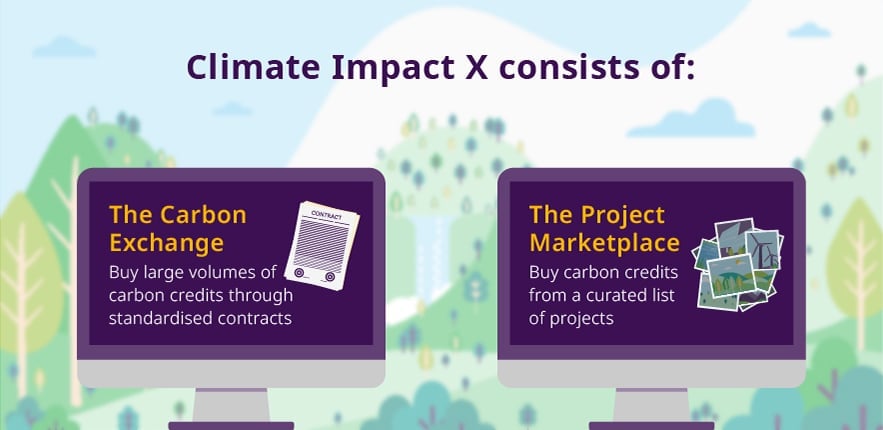

To meet the global demand, a trusted international carbon marketplace will be essential. Yet, existing current carbon credit markets are often fragmented, with prices that vary across the markets. Temasek will be partnering with DBS, Standard Chartered and the Singapore Exchange to launch Climate Impact X (CIX) — a global exchange and marketplace for high-quality carbon credits — to fill this gap.

“CIX will enable efficient price discovery and catalyse the development of new projects, by leveraging a well-functioning marketplace with strong impact and risk data,” says Mikkel Larsen, interim CEO of CIX and Chief Sustainability Officer at DBS.

A special focus of CIX will be on catalysing nature-based solutions — a critical part of the world's net zero transition. Nature-based solutions are long-term projects that conserve and restore the carbon-rich natural ecosystems we have. By protecting nature, such solutions have the potential to not just support biodiversity but also increase the resilience of local communities.

“If you look hard at climate change, as many of us are doing now, it's easy to be overwhelmed,” admits Temasek's Howard. The future isn't written yet, however. “We can still be the generation that stops global warming,” he says.

Net zero by 2050 is a clear destination for Temasek. To get there, Howard shares that the company is actively working with partners and supporting them as they transform their businesses. “We're also leaning into new investment opportunities, where we can invest and help scale the businesses of the future.”

“There's tremendous potential to tackle the problem of climate change,” says Howard. “Let's say it's just after dawn of the day where we've decided to fight climate change. And it's going to be an incredibly exciting day.”

Temasek is an investor in DBS, Eavor, Standard Chartered and Svante, and a founding partner of Climate Impact X.