The Next Normal: How China's Gen Z is Fuelling the Post-Pandemic Economy

The rising economic influence of Gen Z consumers, supported by a mature digital infrastructure, is enabling the world's second-largest economy to remain resilient despite COVID-19.

- As true digital natives, Generation Z (Gen Z) is emerging as an influential demographic in post-pandemic China, fuelling the country's domestic demand and contributing to its economic resilience.

- Gen Z's strong preference for online shopping and domestic brands is indicative of a shift in Chinese consumption habits in a post-COVID-19 world.

- Temasek has invested in companies like Genki Forest and Kuaishou, which cater to these changing consumption patterns.

After her alarm goes off in the morning, the first thing that Curley Huang does is to reach for her smartphone. “I check WeChat Moments for any updates I might have missed, then hop onto Weibo for news,” says Huang, 22, a recent college graduate in Beijing. “While commuting, I may be reading articles on my smartphone or watching videos on it.”

Like most of her peers, Huang spends a big part of her day on mobile apps such as microblogging platform Weibo and social commerce app RED. She is one of roughly 400 million Gen Z-ers in China.

Defined as the cohort born between 1995 and 2010, Gen Z is set to become the next engine of global consumption. Nowhere is this more prominent than in China. The first country to grapple with the pandemic, China was also the first to reopen its economy — and it offers a tantalising glimpse of the “next normal” to come.

“Already, we're witnessing the Chinese economy bounce back from adversity,” says Ronald Liu, Managing Director of Investment at Temasek, who is based in Beijing and oversees investments in China.

China's economy grew by 18.3 per cent in the first quarter this year compared to the same period last year. “Partly, this is fuelled by consistent domestic demand and a mature digital economy,” explains Liu. “As digital natives, Gen Z is leading this growth and emerging as an important consumer market.”

“There were already signs of these trends in pre-pandemic China; COVID-19 simply magnified and accelerated their development,” adds Liu. The numbers show just how far they have come. Despite making up just 15 per cent of the population in China, Gen Z accounts for 25 per cent of expenditure on new brands — proof of their rising purchasing power.

A Generation of Digital Natives Comes of Age

As the first generation of true digital natives in China, Gen Z-ers have never known a world without the internet and social media. Technology is second nature to them, observes Liu. They flit from app to app browsing social feeds, making purchases and even starting their own e-commerce businesses. According to China-based analytics company QuestMobile, approximately 320 million Gen Z-ers surf the internet on their smartphones at an average of almost 175 hours a month, or close to six hours per day.

Chinese Gen Z-ers also tend to be spontaneous when it comes to making purchasing decisions, according to a separate survey by management consulting firm McKinsey. They often decide to buy products on a whim — more so than their counterparts overseas.

“Personally, I prefer online shopping,” says Allen Lu, 22, a Gen Z graduate who works in Shanghai. “It's cheaper and more convenient. Ever since the pandemic struck, I basically shop online almost 100 per cent of the time now.”

Online word-of-mouth, such as product reviews on popular e-commerce sites Taobao and Tmall as well as the opinions of friends and family on social media, also exert a strong hold on Gen Z. The same McKinsey survey revealed that 44 per cent of Gen Z consumers rank key opinion leaders among their top three sources of influence.

“If my favourite livestreamer is endorsing a particular drink or clothing, I would be more inclined to buy them,” says Huang, a Gen Z-er who frequents livestreaming platforms. “I trust their product recommendations, regardless of whether they are global or domestic brands.”

This could explain why products that strongly appeal to Gen Z, like the “Zero Sugar, Zero Fat, Zero Calorie” beverage Genki Forest, have an online-first approach to marketing. The brand courts Gen Z-ers on their preferred platforms, like the popular video sharing site Bilibili, and has also sponsored shows like The Irresistible — available on both offline and online broadcasting platforms — that featured a cast of celebrity hosts.

According to Zong Hao, Vice-President of Genki Forest, the brand's attractive packaging and focus on natural, premium ingredients directly addresses Gen Z-ers' demand for high quality products.

Wealthier and better educated than their parents, Gen Z-ers are less price-sensitive and more inclined to go for high quality products, Temasek's Liu notes. “Having experienced China's economic boom in the late 1990s to the early 2000s, Gen Z-ers have a strong sense of national identity and are proud to support domestic brands,” Liu elaborates. “In the past, the term 'Made in China' has been used as a pejorative label. Now it has become a signifier of quality and national pride.”

Having experienced China's economic boom in the late 1990s to the early 2000s, Gen Z-ers have a strong sense of national identity and are proud to support domestic brands.

Ronald Liu

Managing Director, Investment

Temasek

Resilience Powered by a Predominantly Digital Economy

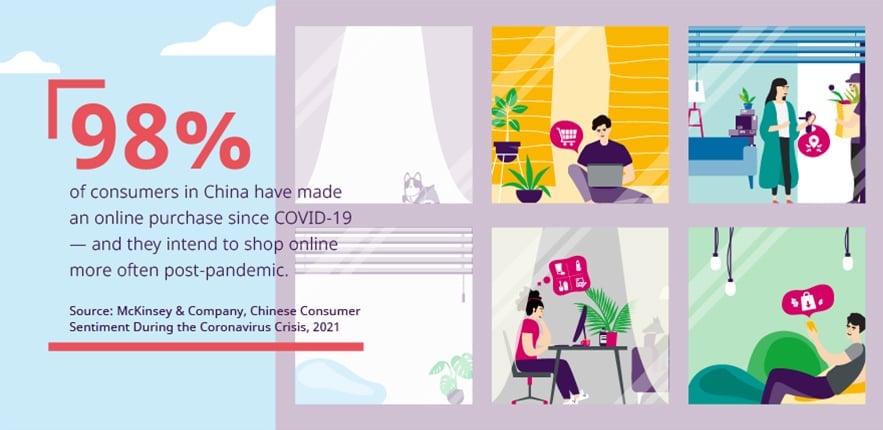

Before COVID-19, China was already a digital leader, accounting for 45 per cent of global e-commerce transactions in 2018. The pandemic has driven the emergence of new digital solutions, transforming consumer behaviour in ways that are likely to endure.

For instance, a study found that over 55 per cent of consumers are likely to continue buying more groceries online after the pandemic.

This has also generated more avenues for entrepreneurship amongst Chinese Gen Z-ers. In certain cases, digital means have become a social leveller, enabling citizens in rural areas to eke out a living for themselves, or to promote social causes.

Ever since the pandemic struck, Yang Shuting, 30, better known by her online moniker “Miss Flower Fairy on Four Wheels”, has used the livestreaming-based, short video social platform Kuaishou to sell local produce as well as handcrafted bags and pouches.

By employing people from lower income or handicapped backgrounds, Yang, who uses a wheelchair after an accident ten years ago, is using her platform to help others in need. “I started livestreaming as a way to share my personal experiences and hoping that others can benefit from them,” says Yang. “But when COVID-19 happened, it became my most important means of contact with the outside world.”

Yang believes that her Gen Z fans are drawn to livestreamers who are authentic and relatable. “I find that they vastly prefer personal stories, anecdotes and advice,” says Yang.

China is a unique case study of how the confluence of Gen Z's strong appetite for domestic brands and key digital players have contributed to a flourishing digital economy. In turn, this digital economy has helped the country weather the challenges of COVID-19.

“By 2025, Gen Z will make up a quarter of Asia Pacific's population,” says Temasek's Liu. “They are right on the cusp of a new spending revolution, powered by digital means.”

“At Temasek, we have observed that more and more Chinese brands are using digital means to increase their market penetration nationwide,” he adds. “Domestic brands that successfully leverage this new opportunity will be able to expand abroad, and become global brands.”

Temasek is an investor in Alibaba, Genki Forest and Kuaishou. Our investments continue to be guided by structural trends such as Digitisation and Future of Consumption, which reflects shifts in global consumption patterns.