Investment Update

We continually invest for the long term in line with structural trends, even as we remain watchful of the risks and opportunities arising from disruptive events.

We had a very active year despite COVID-19. During the financial year ended 31 March 2021, we invested S$49 billion and divested S$39 billion: record numbers on both counts.

Some of our large investments helped enable our portfolio companies to reposition for the post-COVID world. We continued to deploy capital into opportunities that were aligned with our focus on long term trends. Some technology trends, like digitisation, have been accelerated by the COVID-19 pandemic. We also realised gains from divestments based on our intrinsic value tests.

The transition towards low carbon economies and sustainable lifestyles is not only an imperative, but also presents us with new investment opportunities. We have increased our focus on businesses with innovative products, services and business models that drive decarbonisation, resource efficiencies, and material and process innovation. We have also forged novel partnerships with other investors who are committed to achieving a net zero world to scale feasible novel energy solutions, mobility, the built environment and manufacturing sectors.

Environmental, Social and Governance (ESG) considerations are integral to our investment decision-making processes. This enhances our existing investment practices, supports our investment decision making, and safeguards Temasek’s reputation. It is well aligned with our objective of generating sustainable returns, by investing with a long term view, and frames our engagement with our portfolio companies and fund managers on sustainability priorities.

ESG considerations are integral to our investment decision-making processes.

We continually evolve and strengthen our ESG framework. Our ESG Investment Management team is now an integral part of our Portfolio Strategy and Risk Group. This is a key step in our journey to integrate and advance ESG considerations across all of our global investments.

We moved decisively on the contribution and exposure to climate change from our investments. We incorporated an initial carbon pricing of US$42 per tonne of carbon dioxide equivalent (tCO2e) in our investment analyses. This pilot helped to guide decision making in line with broader climate targets and model the likely future impact of carbon pricing on the investments we make. We expect to increase the cost each year through to 2030, in tandem with our ambition to deliver on our carbon abatement targets.

In addition to our direct investments, we have engaged the managers of the private equity funds and credit funds, to review the alignment of their focus with our ESG stance as well as the maturity of their ESG practices. The assessment will inform our future engagement with these fund managers and other like-minded investors, to promote ESG practices and reporting for funds.

We are continually building our ESG capabilities across the firm. Our investment professionals are required to fulfil training on our methodologies and processes. Their analyses are supported by a network of ESG champions and a team of dedicated ESG professionals.

Investment Highlights

We had significant activity in the technology, financial services, industrials and energy sectors.

During the year, we invested in several technology companies that ride on the structural trends we have identified. These included investments in Roblox, an online entertainment platform; Snyk, a software developer of cybersecurity tools; Hopin, a virtual live events management platform; TSMC, a semiconductor manufacturer; and NUVIA, a chip design start-up which has since been acquired by Qualcomm. We also made follow-on investments in Kuaishou, a digital media platform; and UST Global, a provider of technology services and solutions.

We had significant activity in the technology, financial services, industrials and energy sectors.

We continued to increase our exposure to payments and financial technology companies that stand to benefit from the acceleration in digitisation of financial services. This included investments in FNZ, a UK-based wealth management platform; and Nium, a Singapore start-up that facilitates global digital payments and card issuance. We increased our investments in Flywire, a US-based cross-border payment service platform that recently listed in the US; and TrueLayer, a UK-based fintech platform that enables financial apps to access bank data and make transactions securely. We also invested in BlackRock, a global asset manager with a diversified product offering and client base.

Our investments in the industrials & energy sectors included Eavor Technologies, a Canada-based company developing proprietary technology to harvest geothermal energy; and a follow-on investment in Assa Abloy, a company specialising in access and security solutions based in Sweden. We partnered Schneider Electric India Private Limited, a company focused on energy efficiency and digital transformation of energy management systems and industrial automation, to acquire India-based conglomerate Larsen & Toubro’s electrical and automation business, in a transaction that was completed during the year.

In line with our focus on sustainable solutions, we invested in Rivulis, an Israel-headquartered company providing water-saving technology solutions to farmers worldwide; and Solugen, a US-based specialty chemicals manufacturing platform that aims to decarbonise the chemicals industry. We also increased our position in InnovaFeed, a French biotechnology company producing insect protein that is used to manufacture sustainable animal feed.

(Photo: Rivulis; photo taken before COVID-19)

We are working with partners to advance decarbonisation solutions. In April this year, we announced a partnership with BlackRock to launch a series of late stage venture capital and early growth private equity investment funds that will focus on advancing decarbonisation solutions to accelerate global efforts to achieve a net zero economy by 2050. BlackRock and Temasek are committing a combined US$600 million in initial capital.

In China, we invested in companies riding on the digitisation trend. As demand for online education services increases, in part due to the pandemic, we invested in Trustbridge Global Media, an online children’s content platform. We invested in Tezign, a creative cloud platform; Didi Freight, a digital truck matching platform specialising in on-demand freight services; and Black Lake Technologies, a manufacturing operations management software as a service provider.

In Singapore, we invested in some of our portfolio companies. This included participation in Singapore Airlines’ S$8.8 billion rights issue of shares and mandatory convertible bonds in May 2020, after the company had received close to 100% approval from all shareholders at an extraordinary general meeting in April 2020, for a rights issue of up to S$15 billion. Funds raised will help the airline ride through the COVID-19 pandemic, and recover with a strong and resilient balance sheet. We invested in Sembcorp Marine as part of its demerger from Sembcorp Industries — a transaction designed to allow each of the businesses to focus more on their respective strengths.

Additionally, we invested in growth companies including XCL Education, a K-12 education platform with a presence across Vietnam, Malaysia, and Singapore; and made a follow-on investment alongside Heliconia Capital in Tessa Therapeutics, a Singapore-based early stage company developing cell therapies to treat cancer.

In North America, we invested in Snowflake, a cloud data warehouse software provider; Apeel, an agritech innovator which produces edible plant-based fruit and vegetable coatings that extend the shelf life of perishable produce; and Svante, a company developing proprietary low cost carbon capture technology.

In Europe, we invested in German company BioNTech, a biotechnology company focused on next generation cancer treatment solutions, which most recently pivoted to jointly develop the Pfizer-BioNTech COVID-19 vaccine; as well as UK-based Tropic Biosciences, a biotechnology company developing high performing commercial tropical crops.

We stepped up our exposure to Southeast Asia, riding on structural trends in the region, such as a growing middle income population and a thriving Internet economy. We invested in e-commerce companies Sea Limited and Indonesia-based Tokopedia, which has since been merged with Gojek to form GoTo Group. We also made a follow-on investment in Social Bella, a vertically-focused platform in beauty and personal care in Indonesia.

We stepped up our exposure to Southeast Asia, riding on structural trends in the region.

Post 31 March, we increased our investment in Alan SA, a digital health insurer based in France; and invested in Insitro, an AI-driven drug discovery and development company. We also invested in Grab as part of the company’s funding round in April.

Catalysing Innovative Solutions

After a year of incubation, our Blockchain pod founded LemmaTree, a group of companies that seeks to use decentralised technologies to develop self-sovereign identity solutions, empowering individuals and organisations to control their data.

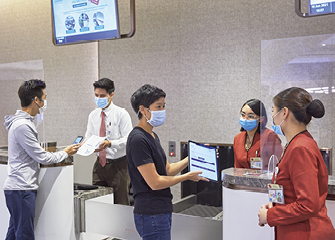

Affinidi, a LemmaTree company, enables the creation and sharing of digital identities that are portable and verifiable. Affinidi's technology has been applied towards facilitating safe travel by enabling the digital verification of health credentials and ensuring passengers meet destination country travel requirements. This is currently being piloted by 18 customers in Asia and the Middle East.

Additionally, we founded two companies that have been built using Affinidi’s technology: GoodWorker, to deliver job matching, upskilling, financial and other services to blue-collar workers in India; and Trustana, a cross-border B2B trade platform focused on the food & beverage industry.

Our AI pod founded a Centre of Excellence to build deep expertise in AI and to work with our portfolio companies to use AI to deliver better commercial outcomes and develop new business opportunities. The AI pod is also incubating a venture focused on using AI to engage customers. Temasek joined Singapore Computer Society’s corporate pledge initiative to promote the responsible use of AI and data — we nominated a representative to the Society’s AI Ethics and Governance Certification Committee to promote training and certification in AI.

We founded a Centre of Excellence to build deep expertise in AI and to work with portfolio companies to use AI to develop new business opportunities.

We continue to support start-ups in our portfolio as they scaled their operations over the past year. We increased our position in Perfect Day, a company producing animal-free dairy proteins, and helped facilitate the launch of their joint lab in Singapore with the Agency for Science, Technology and Research (A*STAR). The lab will tap on local researchers, scientists and engineers to support Perfect Day’s global research and development activities. We made a follow-on investment in Zipline, which uses autonomous drones to deliver crucial medical supplies, such as vaccines and blood products, in Africa and the US.

Strengthening Enterprises

Following a voting approval of around 99% of its shareholders, Sembcorp Marine (SCM) raised S$2.1 billion in a rights issuance in September 2020 for its recapitalisation. SCM was then demerged from Sembcorp Industries (SCI) via a dividend in specie of SCM shares by SCI to its shareholders. Both SCI and SCM will focus on extending their business models to embrace green energy solutions, such as renewables, building on their respective core engineering capabilities.

Temasek sub-underwrote S$600 million of the SCM rights issuance, and became a direct shareholder of both SCI (49% stake) and SCM (43% stake), after their demerger.

In October 2020, Temasek established Seviora Holdings, our asset management group comprising four existing companies currently owned by, or affiliated with, Temasek — namely, Azalea Investment Management, Fullerton Fund Management Company, InnoVen Capital, and Seatown Holdings International. With a dedicated and integrated management team, Seviora will have scale and synergistic product offerings for accelerated growth, building on the brands and track records of each asset management company.

An Enabler of Growth Capital

Heliconia Capital is a growth fund set up by Temasek in 2012 to focus on Singapore-based small and medium enterprises. During the year, it invested in the consumer, technology and healthcare sectors. These included Glife Technologies, a fresh produce platform that connects farms directly with food and beverage businesses and consumers. Investments were made in CSE Global, a listed engineering solution provider, as well as Flexxon, which develops flash storage and memory solutions. Heliconia also invested in Pacific International Lines, an established container shipping carrier in Southeast Asia.