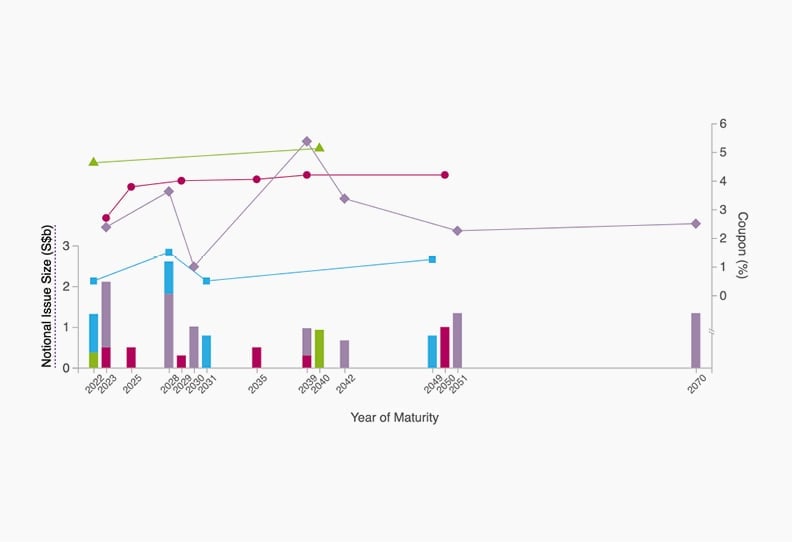

Credit Quality

Our Temasek Credit Profile is a snapshot of our credit quality and financial strength. For these ratios, the lower the percentage, the higher the credit quality.

(for year ended 31 March)

Total Debt

5% of Net Portfolio Value

- Total Debt

- Net Portfolio Value

Total Debt

12% of Liquid

Assets

- Total Debt

- Liquid Assets

Interest Expense

4% of Dividend Income

- Interest Expense

- Dividend Income

Interest Expense

1% of Recurring

Income

- Interest Expense

- Recurring Income

Total Debt due in One Year

5% of Recurring

Income

- Total Debt due in One Year

- Recurring Income

Total Debt due in next 10 Years

18% of Liquidity

Balance

- Total Debt due in next 10 Years

- Liquidity Balance

As an investment company, our dividend income and divestment proceeds are used to pay our business expenses; bond investors; taxes to the government; dividends to our shareholder; and make investments.

For the year ended 31 March 2021, Temasek earned S$8 billion in dividend income and divested S$39 billion. These amounts formed the bulk of our cash inflows.

Unlike pension or oil funds, we do not have inflows from pension contributions or oil revenues. Temasek had S$18 billion of debt outstanding as at 31 March 2021.

Our interest expense for the year ended 31 March 2021 was about 4% of our dividend income.

(for year ended 31 March)

Key Credit Parameters (in S$ billion)

| For year ended 31 March | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Divestments | 18 | 16 | 28 | 26 | 39 |

| Dividend income | 7.0 | 9.0 | 8.5 | 11.9 | 8.4 |

| Income from investments | 0.2 | 0.3 | 0.4 | 0.8 | 0.7 |

| Interest income | 0.2 | 0.2 | 0.4 | 0.7 | 0.1 |

| Interest expense | 0.4 | 0.4 | 0.4 | 0.4 | 0.4 |

| Net portfolio value | 275 | 308 | 313 | 306 | 381 |

| Liquid assets | 91.1 | 110.3 | 112.2 | 112.4 | 143.1 |

| Liquidity balance | 37.6 | 33.2 | 44.2 | 47.1 | 50.8 |

| Total debt | 12.8 | 12.8 | 15.1 | 13.9 | 17.6 |